TRANSLATION NOTES: Please read some comments at the end of this post.

What is the property valuation

As I mentioned earlier, the appraisal can be considered a transaction to an object in order to find a reference value known as assessed value. A property may have  multiple appraisals, with different methodologies and dates. Is usually below market value (between 40 and 60%), not only because it comes from a massive study but because generally are not considered some factors that influence the final market value, as the overhead for professional services, advertising costs and administrative costs of the development company.

multiple appraisals, with different methodologies and dates. Is usually below market value (between 40 and 60%), not only because it comes from a massive study but because generally are not considered some factors that influence the final market value, as the overhead for professional services, advertising costs and administrative costs of the development company.

Its usefulness

The most common use is for use in the collection of property tax or property tax. The purpose of appraisal is a law of social equity contribution, assuming that the tax is distributed to the extent of the value of the property (pays more who has more).

Its application

The laws of each country change in this tax implementation, such as El Salvador, where does not exist under that name, and in Colombia’s case where this tax includes:

The tax for parks and tree planting

The tax for socioeconomic stratification

Land surveying Surcharge

There are also different forms of applications, some under local autonomy, as in the Honduras case and others under centralized control as in Spain, where the Ministry of Finance make the study of values by zones, but the municipalities do presentations for conclusion of local taxes.

Rates usually go between 1 and 15% of every thousand; it means that a property valued at $ 200,000 if the rate would be 4% would pay $ 400 per year. It does not seem much, but usually the second heaviest, when we remember that there is  another type of direct taxes:

another type of direct taxes:

Industry and Trade

Surcharge on gasoline

Street lighting

Labels

Environmental Surcharge

Delineation and planning

Train toilet, fire and other services

Urban assessment

Broadly speaking, urban valuation using the replacement cost method (there are others) less accumulated depreciation has two components:

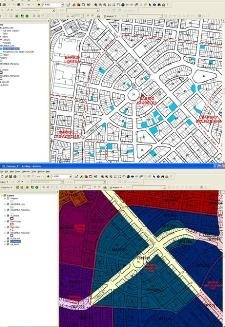

The value of the land. This normally comes from a study based on market transactions, which if done in a representative way can result in homogeneous areas where you can get approximate values of the land.

Additionally, there are factors that influence individually on specific properties:

Corner condition that can ride at 15%

Topography

This gets the value of the land

In Medellin case there are considered as values that affects land topography value, soil use, roads and public services. And these areas are called geo-economic homogeneous areas and regression tables in another post we will show the complete process of Medellin.

The building value, this applies from constructive types studies based on the weighting of typical buildings, which in turn were calculated by unit cost chips. After the capture process classifies the constructive elements that influence the value; so we can consider: the use for which the building  was built, class materials and quality of labor or sum of constructive elements weights, it can be defined to which constructive type corresponds.

was built, class materials and quality of labor or sum of constructive elements weights, it can be defined to which constructive type corresponds.

Once identified the constructive typology that applies it is multiplied by the total number of square meters, if there are more than a first floor applies a change factor and the sum generates the value of the building.

Additionally, we apply the depreciation factor, for which it is also used a table based on years of building construction and the restoration it has received. For special buildings appraisals are done using other methods, such as in the case of resorts, industrial zones, technology-oriented, airports etc. Additional details are calculated separately, although they are also in the study of buildings.

Thus the urban appraisal consists of the sum of:

The value of land

The value of building

The value of additional details

Rural appraisal

Rural appraisal

The rural value of or rustic is similar to urban having the following components:

The value of land, for studies of land values there are special methods based on the ratio of market value and productivity within a given a economic and climate area. This classification includes factors of physical, topographical, climatic, geographic and basic access for production.

So it is a soil classification based on their agrological ability which also becomes in a homogeneous area. The value will be determined by the value per square meter of area, the area of the plot, this unlike the urban has modifying factors that influence their value like:

Distance to commercial nodes

Access to roads

Distance to water source or irrigation system

Topography

Once applied, you get the value of rural land

Also the rural land value includes the buildings value; building typologies studies may include traditional constructions in rural areas such as warehouses, farms, galleries etc. There will also be additional details that could be calculated separately as in urban areas, like swimming pools, porches, walls, veneers, flooring, staircases, etc.

The value of permanent crops, for this, usually the study based on input costs,  labor and mechanization ends on average to different plants (coffee, cacao, African palm etc.), or in grass case per square meter. And these will have change factors related to the expectation of productivity that are still waiting for this crop, including:

labor and mechanization ends on average to different plants (coffee, cacao, African palm etc.), or in grass case per square meter. And these will have change factors related to the expectation of productivity that are still waiting for this crop, including:

Health status

Age of plants

Then, the product of the total number of plants, for the cultivation cost and multiplied by its modification factors will be the value of permanent crops.

Then the rural appraisal will consist of the sum of:

The value of land

The value of buildings or improvements

The value of additional details

The value of permanent crops

Is it worth it?

It is possible that some of you, by half of the post felt like if they were singing capon cock’s game before Melquiades come to a cure of insomnia in Macondo (*).

But it’s worth, at least if it is for property tax purposes. In the case of Colombia, therefore, to give effect to the three phases of the Medellin Update Cadastral, whose total investment amounted to about 8.840 million of pesos, the additional revenues that can be charged to the project by way of Property Tax in the first 3 years of operation is equivalent to about fifteen times the amount invested.

As a leading institution of tax or cadastral area implements, systematizes and gives continuity to a methodology, valuation can be a very effective exercise useful not only for tax matters. The cost of individual initiatives or hybrid methodologies can be greater than expected revenue.

It also affects the poor policies in the municipal labor competition, when political patronage makes it necessary to be training people every time there occurs a government’s change.

TRANSLATION NOTES:

(*) capon cock’s tale: This is a tale that appears in Gabriel Garcia Marquez novel: 100 years of solitude, the capon is farmyard chicken whose mesh is finer than common chickens. The insomnia in Macondo is a situation that also appears in this novel.

The author’s intention with this compound phrase is to mean that probably the reader is feeling a little dizzy and desperate with a rather confuse process but this is the only way to go ahead on this job.

Autocad Software, Bentley Microstation, Gis Google Earth, Gis System Geomate Provides Services For Complete Gis Software And Solutions, Autocad Software, Autocad Courses, Bentley Microstation, Microstation Software, Gis Google Earth, Open Source Gis And More.

Autocad Software, Bentley Microstation, Gis Google Earth, Gis System Geomate Provides Services For Complete Gis Software And Solutions, Autocad Software, Autocad Courses, Bentley Microstation, Microstation Software, Gis Google Earth, Open Source Gis And More.